< Back to insights

Published 08. Jun. 2021

Breaking Down Silos in Insurance With No-Code Technology

The journey towards improving the customer experience for insurers will require a digital-first mentality in today's online-centric market.

In recent years, Insurers have sought to digitalize their processes and improve their customer experience, making it more seamless and tailored to the needs of today’s digital consumers. Many large incumbents have partnered with insurtechs and invested in technology platforms to digitalize their selling or claims management process, establish virtual payment options, or improve their websites’ usability with chatbots.

While digitalizing parts of the customer journey was a great initial step, it did not address the industry’s core problem. That is, adopting a truly digital-first mindset, rather than offering unchanged products with an online quote and bind journey and putting band-aid solutions on outdated business models.

Silos Across Business Lines and Distribution Channels

Purchasing insurance products is a cumbersome process, and most customers utilize both offline and online channels to research their options and gather the necessary information before they are confident of making a purchase.

For this reason, digitalizing processes in insurance companies should not be seen as a replacement for the existing agency model. On the contrary: digital technology should help insurers to automate standard processes and enable the agent as they advise the client to add an extra layer of personalized services. From a productivity perspective, digital technology can free up the human workforce to focus on more value-added tasks and extend the capability of selling insurance at the point of sale or through non-traditional partners, let it be for valuables, travel, mortgage insurance, or SME risk covers.

As Manisha Bhargava, Head of Global Sales at Innoveo explains, “consumers are merely covering their risk to insulate themselves, their families and their lifestyle from potentially disruptive events that may impact them financially. They are not seeking to buy “insurance”. Innovative Insurers should put their customer first as they build products, with the changing customer lifestyle at the center of their offerings.”

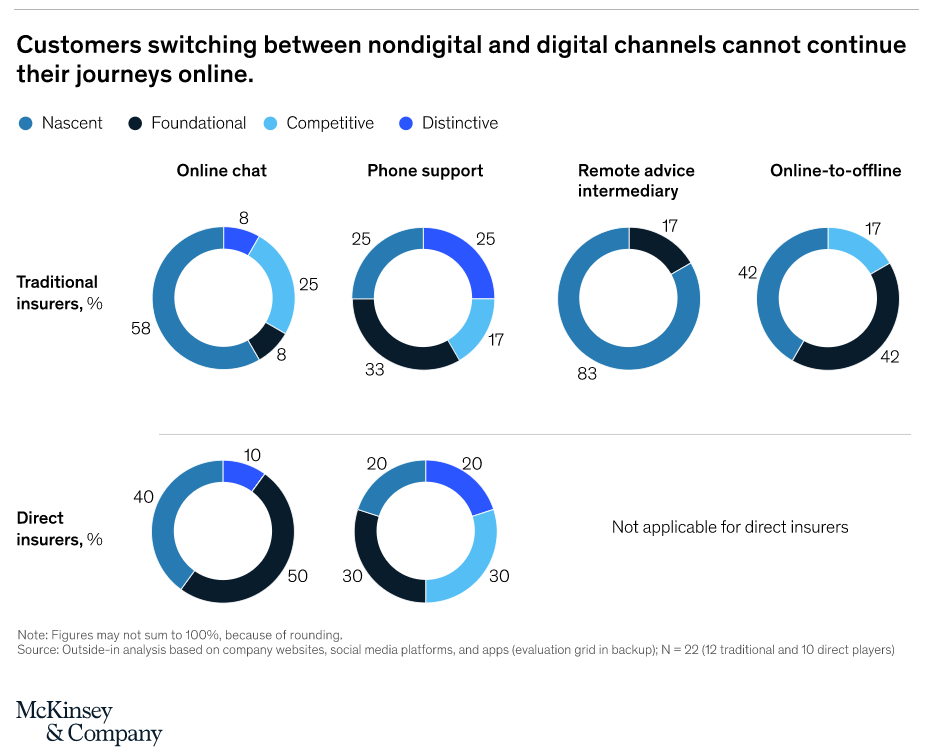

To achieve that, insurance companies have a lot of customer data on their hands. The trouble is that it is siloed across multiple legacy systems. For example, when it comes to the integration of online and offline distribution channels, a 2019 McKinsey survey concluded that in the vast majority of cases, insurance customers who switch between digital and non-digital channels still cannot continue their journeys online. In other words, even though many insurers have some type of lead routing from their landing page to their offline sales and service channels, due to the lack of channel integration, this usually remains a one-way street, leaving customers with a broken digital journey. Those who have compared product offerings online and then called an agent to seek in-person advice, no longer have the possibility to get back to the digital buying journey that they started in the first place.

Strong Demand for Digital-native Insurance Products

As E&Y points out, the penetration rate of both life and non-life insurance segments already had a declining tendency years before COVID-19, especially in the USA. The number of policies sold has fallen, as products that were once attractive to consumers no longer meet their needs.

Traditionally, large insurance carriers operate with separate business lines, based on the type of risk that they cover. This operational logic does not reflect our current lifestyle, where we make decisions in a digital space and expect to have instant access to information. As consumers are getting used to seamless online journeys like ordering products on Amazon or signing up for Netflix based on their individual preferences, it is logical that they would expect the same, sophisticated experience when looking for insurance coverage online.

Despite the increasing demand for digital-native products, the percentage of insurers who offer more complex insurance products for purchase online remains low, according to another recent McKinsey research for the European market. McKinsey also finds that approximately 66 percent of insurtechs specialize in select parts of the value chain, such as data collection, while less than 10 percent aim to disrupt the full business model. If we add the fact that most of the industry still relies on face-to-face interactions, we can see that there is a huge opportunity for digital disruptors and those who are willing to embrace new technology.

Join our exclusive IndustryForum Insurance event in Switzerland and Germany or the Nordic IndustryForum Banking and Insurance event in Sweden.

The Relevance of No-Code for Insurers

To maximize customer lifetime value and increase conversion rates, it is key to reduce the complexity of the buying journey for customers and agents alike, and this is where no-code platforms come into play. If an agent or broker wants to scale his business, it is no longer sustainable that three different customer calls’ data would land in three different CRM systems. To connect the dots across those data silos, insurance companies need software that could sit on top of all their legacy systems.

“Because of hard-coded legacy systems that incumbents depend on for specific product lines, their adaptability is painful and expensive. A no-code platform like Innoveo Skye® has a pivotal role in making this digital transformation smooth and incredibly fast”, Manisha Bhargava argues. “When you adopt a broader, turn-key solution like Innoveo’s no-code platform, an insurance product becomes nothing but a data model. And the moment you abstract the process this way, you will be able to make systematic improvements and break silos across the whole value chain.”

Overall, no-code platforms present an untapped opportunity for the insurance industry. With Innoveo Skye®, insurers can have all their business lines, agents, brokers, and customers in one platform, creating an omnichannel experience. The platform also lets them configure private and public channels and define which functionality is available to each one of them, which provides the flexibility to combine and package various products to their customers.

If insurance companies truly want to get closer to their customers and cater to their needs, then it is crucial to increase the frequency of touch with their end customers, and understand that they are looking for an effective, secure, and easy way to cover their risk. They want products that offer holistic coverage, and they expect insurance providers to be proactive in risk prevention, by using the data available in their possession.

With the words of Manisha, “true digitalization in insurance means to deliver on the 5Es (excite, educate, enable, execute and empower the buyer) through the buying journey without the need for any physical interaction.”

Written by Barbara Péterfi, Content Marketing Manager, and Manisha Bhargava, Head of Global Sales at Innoveo.