Skift Take

ON24 has had a steep year-over-year decline in revenue with an operating loss of $5.7 million in the last quarter. How will this legacy company respond?

ON24 attributes its negative revenues in the first quarter of 2022 to client budget rationalizations, the high cost of energy, and the dampening effect of the Ukraine crisis on EMEA markets. However, CEO and founder Sharat Sharan and chief financial officer Steven Vattuone believe staying focused on a first-person engagement data model will propel its bounce back.

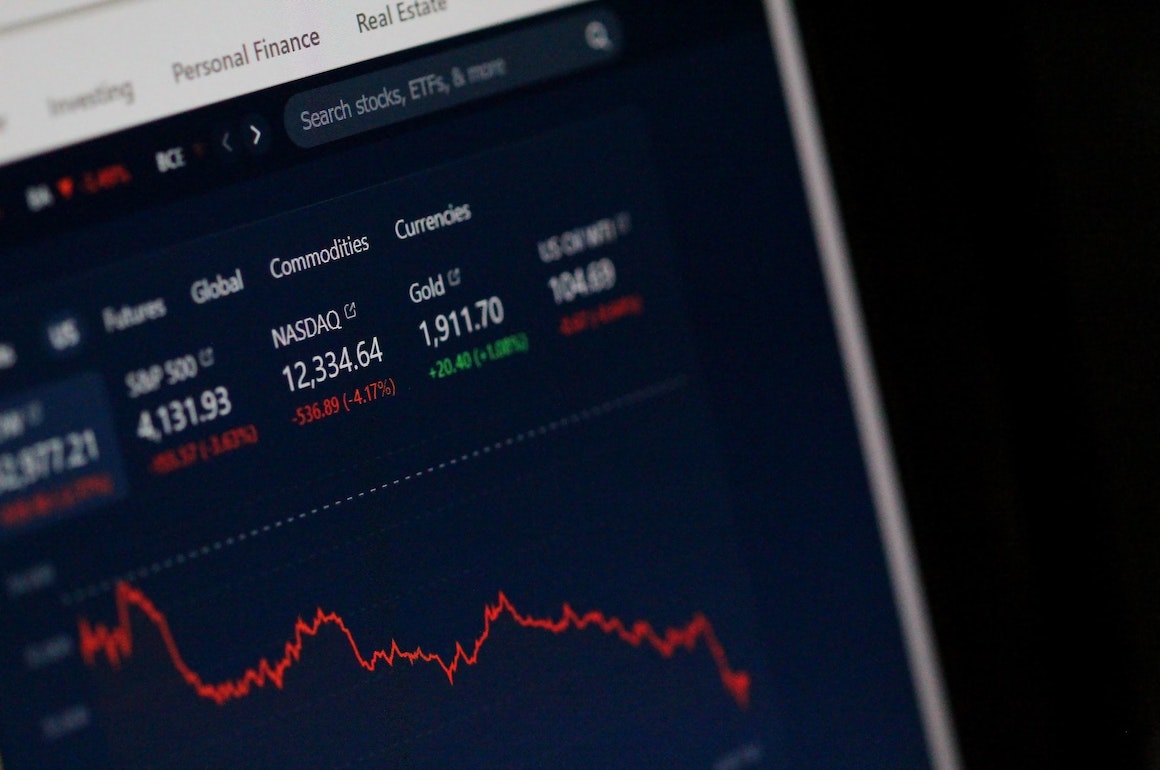

In the past, ON24 has survived by reinvention. Sharon has steered the company he founded in 1998 through the dot-com crash and the Great Recession by aligning its services with emerging trends in client demand. This track record contributed to the success of ON24’s Goldman Sachs-backed IPO in February 2021, when its shares jumped from $50 to $77 the day they went for sale.

But 15 months later, share prices for ON24 present a very different barometer of investor confidence. Following the release of its first-quarter 2022 financial results, its stocks experienced an over 50 percent uptick in trading while shares slid 6.1 percent, hitting $10.77 at closing time – a trend that doesn’t seem like a blip, considering that Goldman Sachs sold 25,000 shares back in March for $12.76.

Despite slightly better results than many analysts expected, ON24 has had a steep year-over-year decline in revenue. Vattuone reported an operating loss of $5.7 million in the last quarter, compared to $2.8 million for the same period last year. Sharan and Vattuone attribute this decline to inflation, the crisis in Ukraine, and contracted enterprise client event budgets.

Vattuone emphasized caution when predicting next term’s profits, noting that current revenue streams for ON24 are uncertain, “particularly as organizations continue to assess their post-pandemic budgets.”

Geopolitical instability has contributed to ON24’s tough quarter. “In 2022, EMEA was 18 percent of our revenue and was one of the faster-growing parts of the business – 60 percent of our total revenue. In the first quarter of 2021, it was 17 percent of our revenue,” said Vattuone.

Sharan added that the rising cost of energy also paused or delayed some subscription deals. “We did not see as much of a pickup in March as we expected. We had several large deals that got paused, and some got delayed as the material costs and the price of gas went up.”

Another trend evident in the numbers is the decrease in professional services revenues, down 30 percent from the same quarter last year. As event professionals become more skilled at integrating targeted event tech features into their experience design, charging to facilitate them will become less of a revenue stream for platform providers. Companies that reaped large returns during the pandemic pivot to digital media engagement channels should take note.

Sharan emphasized that ON24 is “changing our platform to reflect the needs of our customers.” Historically, ON24 has been a survivor. But in terms of how engagement innovations are trending, it seems to be rather late to the game.

Its two-way engagement tool, Forums, was launched in April, and its acquisition of VIBBIO, a user-friendly, video-production tool was publicized just a week later. This was followed by a partnership with Parmonic, an AI tool that generates more digestible segments from long-form webinars, on May 2. These investments have impacted ON24’s current in-the-red bottom line, but they are banking they will be worth it in the long term.

Despite the uncomfortable numbers, ON24 is sticking to its emphasis on sales and marketing and enabling its clients to achieve conversion through first-person data capture. This focus may give them an edge in a market that seems increasingly prone to fragmentation.

Both Vattuone and Sharan noted that the effect of post-pandemic budget rationalization from their customer base was “roughly in line with our previous expectations.” The churn they experienced from one-off subscriptions was something that had been accounted for in ON24’s previous financial guidance. As a result, they emphasized, higher-than-anticipated losses were not ultimately a cause for alarm and did not alter their confidence in ON24’s go-to-market strategy.

“Our focus really is to build this sales and marketing digital engagement platform that helps our customers capture first-party data. We have all the interconnected experiences, and that’s the solution, based on hearing from our customers,” Sharan said.

In the light of this quarter’s negative cash flow, it will be interesting to watch how sticky ON24’s move to carve out its niche in the rapidly reconfiguring event tech market will prove to be.

Its relatively stable annual recurring revenue indicates that, at least to this point, its existing enterprise clients are confident that ON24’s new offerings and continued investment in software and ecosystem development make this platform attractive.