Skift Take

Eventbrite announced a massive hit to its revenue during its latest earnings call. The news comes after the announcement of a substantial restructuring of its workforce that saw 45% of its employees laid off. What does the future look like for the ticketing giant?

Eventbrite just reported a very painful quarter performance. Many analysts expected this to happen with the event industry massively impacted by the Covid-19 crisis and its recovery looking very rocky. Yet the depth of the damage is beginning to show — and it is not looking good.

Some key numbers:

- A loss of $146.5 million, compared to a loss of $9.96 million last year

- A drop in revenue of 40%

- A drop of 90% in paid ticket revenue in March

The company also announced a $125 million initial loan from a private equity firm and $77 million in refunds for unused tickets.

At the time of writing and one day after the announcement, the share is down 22%.

Virtual is Mostly Free

Undisputedly Eventbrite has the strongest brand recognition among event technology companies. Thanks to its freemium model, it’s been able to grow its user base and expand into new verticals such as sporting and entertainment.

The Coronavirus crisis has brought up incredible challenges for event planners, forced to cancel or postpone all their events. Many events have been able to pivot to virtual but in most cases missing the paid ticket element that makes companies like Eventbrite survive.

The first two months of the crisis have in fact seen companies transition to free virtual events. Many decided to go free to allow inclusion in a very difficult time of furloughs and layoffs. Apple, Adobe, and many others have opened up events with high ticket prices to the public.

While we may anticipate this trend to phase down, with more paid virtual experiences, the rules of the game have been compromised for the short term, and that requires a lot of liquidity for companies like Eventbrite to stay afloat.

A Complex Recovery

Many associations are rushing the industry into reopening events as soon as possible. Yet the question remains if attendees will feel safe enough to show up.

Large meetings and events seem extremely complex to roll out at the time of writing. Physical distancing, liability, and thermal screening are just some of the items giving headaches to event professionals.

Smaller meetings and events are more likely to happen, and this seems to be the boost Eventbrite is relying on to navigate through the next quarter, which the company admits will be difficult with a “substantial decline in revenues for several quarters.”

The virus adds to an already complex situation for the company resulting from the traumatic acquisition of Ticketfly, followed immediately by a difficult integration and a malicious hack that affected 27 million accounts. The stock is now traded at $8.25 after debuting the market at $36.5.

The Future of Eventbrite

The future of Eventbrite (as for many large event technology companies) is linked to the ability to fully embrace virtual events while the industry recovers.

Many event technology providers passed on implementing virtual tools in the hopes that the crisis would end by the summer. As summer approaches, it is clear that many events that require a three- to four-month production cycle won’t happen.

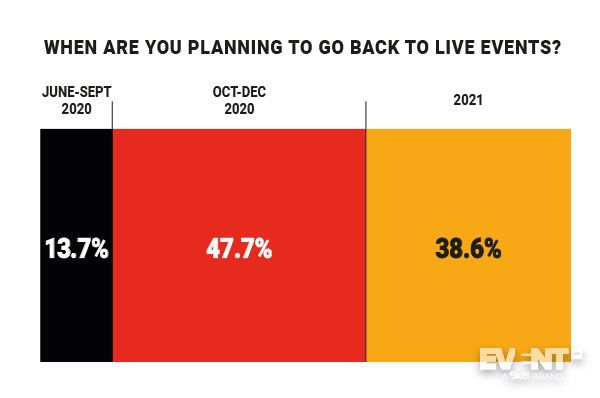

In fact, the majority of planners surveyed by EventMB eye a recovery happening in Q4 2020 or later in 2021.

Consumer confidence will be another indicator to keep an eye on. Currently, Qualtrix research says that 79% of American consumers say they feel uncomfortable attending a live sporting event. If general conditions (better testing, better screening, a cure, a vaccine, herd immunity, a loss of intensity for the virus) do not materialize, even smaller events will struggle to bring in paying audiences.

For the next quarter, it looks more like a liquidity and R&D effort. If Eventbrite will be able to roll out more virtual event technology tools, that will be the lifeline it needs to stay afloat during these times of uncertainty.