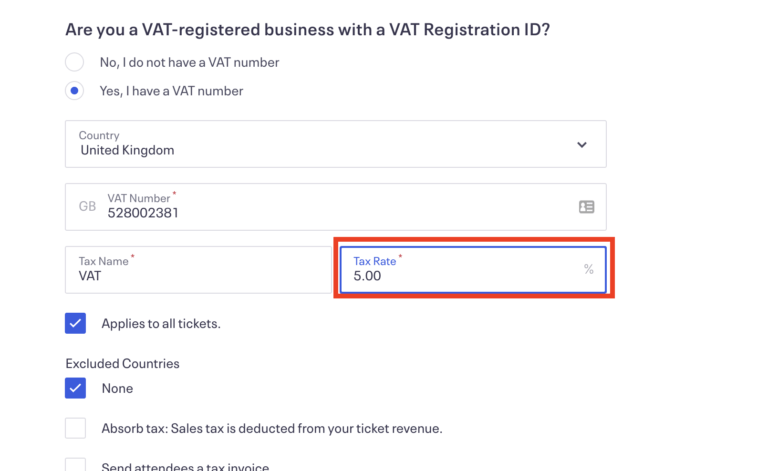

On 8 July 2020, the government announced that it would introduce a temporary 5% reduced rate of VAT for certain supplies relating to:

- hospitality

- hotel and holiday accommodation

- admissions to certain attractions.

This cut in the VAT rate from the standard rate of 20% will have effect from 15 July 2020 to 12 January 2021.

These changes are being brought in as an urgent response to the coronavirus (COVID-19) pandemic to support businesses severely affected by forced closures and social distancing measures.

To find out how to set or update your VAT settings, watch below.